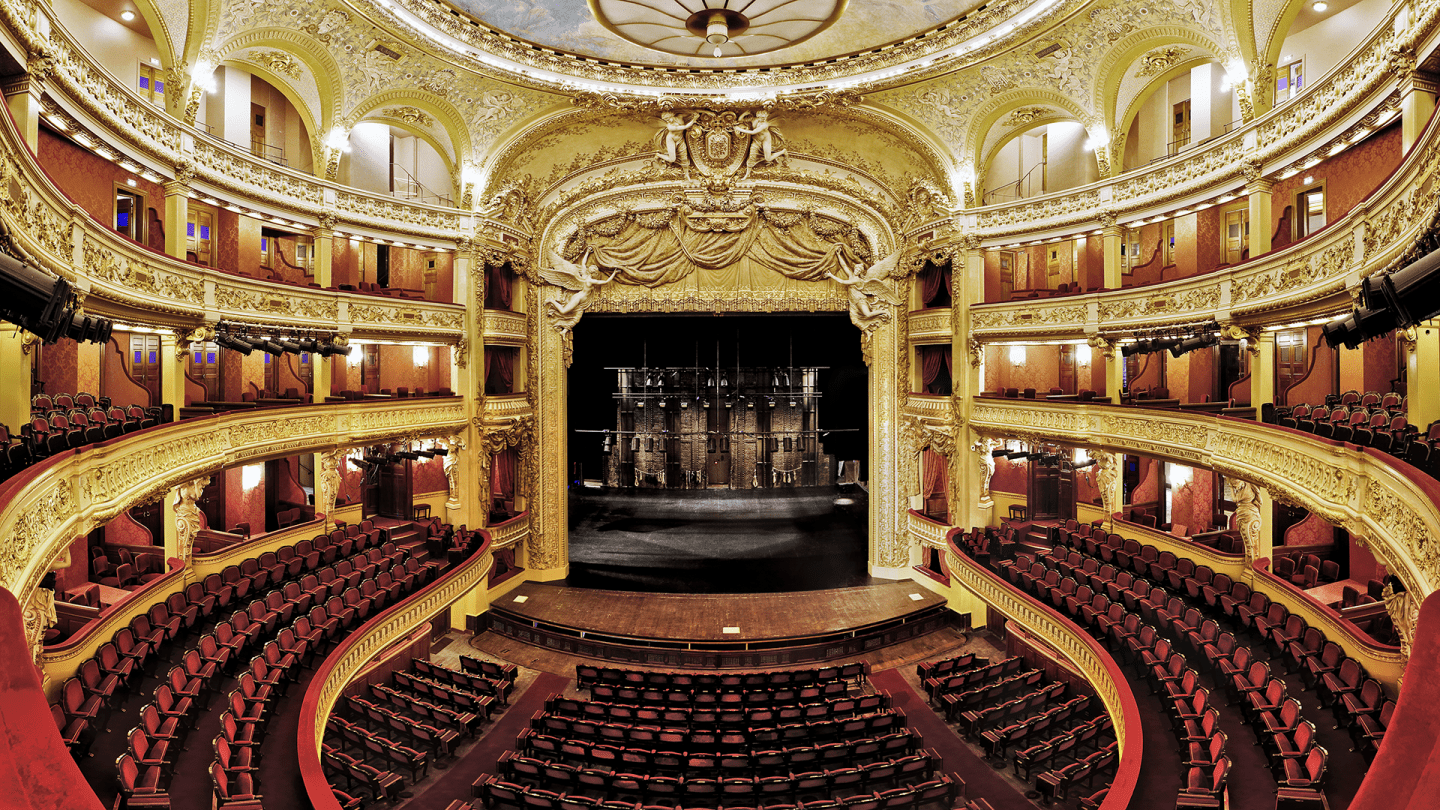

Salle Favart - Opéra-Comique © Stefan Brion

In France

Donation on Income Tax

Your donation to the Opéra Comique, what ever its amount, is 66% tax deductible within 20% of your taxable income, with the possibility to defer it over 5 years if you’ve already reached the annual limit. Skill sponsorships and financial or “in kind” donations from corporate sponsors are 60% tax deductible within 0.5% of the company’s annual turnover up to 20,000€. Surpassing this figure entitles your company to defer the tax deduction over 5 years (Law of 1st August 2003).

Donations on French property tax (IFI)

Donations to the Opéra Comique’s Foundation also entitle you to up to 50,000€ real estate tax reduction (IFI).

Bequests, donations, life-insurances

These gifts or contributions are similar to donations in principle, although they require an notarial act in which the owner shall indicate his/her wishes relating to the preservation and presentation of the art piece. They are totally exempted from transfer duties and the Opéra Comique’s Foundation can receive any form of donation, be it complete or subject to usufruct.

Send us an email for more information.

In Europe

The Opéra Comique’s Foundation is a now a member of Transnational Giving Europe (TGE). You can support the Opéra Comique while benefiting from your own country of residence’s tax advantages by donating via the TGE website.

Send us an email for more information.

In the USA

It is possible to benefit from tax reduction in the USA thanks to the “Friends of the Fondation de France”. Learn about the International Friends of the Opéra Comique and donate from the USA.

Send us an email for more information.

Contact

Camille Rospide-Claverie

Marion Minard